SAVE & PPEL Renewal Vote

On Tuesday, March 3, 2020, Pleasantville School residents can vote on two ballot questions regarding our SAVE Revenue Purpose Statement and PPEL.

A Solution with ZERO Net Property Tax Increase!

Special Election: March 3, 2020

On Tuesday, March 3, 2020, Pleasantville School residents can vote on two ballot questions regarding our SAVE Revenue Purpose Statement and PPEL.

- Question #1 (Proposition B) asks for the approval of a revised Revenue Purpose Statement for the Secure an Advanced Vision for Education (SAVE) fund. This would grant the school district permission to continue to use state penny sales tax dollars toward facility maintenance and construction projects.

- Question #2 (Proposition C) asks voters if the district can continue to levy $1.34 / $1,000 of taxable valuation for Physical Plant and Equipment (PPEL). This would grant the school district permission to continue to use the PPEL funds toward facility maintenance projects.

Frequently Asked Questions

What is the estimated impact if I own property in the district?

Pleasantville Schools has had both SAVE and voted PPEL in place for many years. This is not a new tax. If extended, SAVE has no impact on property taxes as it is funded through a statewide sales tax. PPEL has also been in place for many years in Pleasantville and if approved, would continue to add $1.34/$1,000 of taxable valuation.

Why is the board asking for SAVE and PPEL extension now?

A large number of Iowa schools are asking voters to consider extending the SAVE Revenue Purpose Statement on March 3, 2020 because of the new law that took effect during the last legislative session that requires a community vote to extend the revenue purpose statements. We expect to see several area and regional school districts asking their patrons to extend their SAVE revenue purpose statements in March.

Additionally, the board is asking the community to extend PPEL because the Pleasantville PPEL that was approved back in September of 2010 is set to expire in 2021.

How does the board determine facilities needs?

The board partnered with Estes Construction in April of 2015 to conduct a comprehensive analysis of our current and future facilities needs. The plan was developed in 2015 and can be found HERE. The plan analyzed Pleasantville’s facilities as well as facilities financing capacity, and the board has used this plan to identify and prioritize our school facilities for the past five-years. If the PPEL and SAVE funds are extended on March 3, 2020, the board will continue to use this plan to invest in school facilities.

Will there be any community forums or meetings to learn more about this?

Yes! A schedule outlining various forums and small group meetings is listed below. Patrons are invited and encouraged to attend any/all of the meetings. Community members can also contact Superintendent Tony Aylsworth at (515) 848-0555 or email Taylsworth@pvillecsd.org with any questions, concerns, or meeting invitations.

Open forum Meetings (Location: High School Library)

-

February 25, 6:00 pm

-

February 27, 6:00 pm

Organizational / small group Informational Meetings

-

Library Action Committee - February 10, 10:00 am

-

City Council - Monday, February 17th at 5:30 pm

-

Chamber of Commerce - Friday, Feb 21 at 9:00 am

-

American Legion - February 10, 7:00 pm

-

February 10th - All Pleasantville Staff meeting - 8:00 am

-

Morning coffee with supt meeting - Friday, February 7th at 8:30 am

-

Elementary PTO - February, September 17 at 7:30 pm

-

Booster Club Meeting - Sunday, January 26 at 7:00 pm

Is this vote specifically about a new track and/or stadium?

The possible remodel of the PHS track and stadium has been an ongoing discussion for the school board for at least the past two years. The vote on March 3, 2020 is not specifically a vote about a new track and stadium. However, if the board does approve a project to remodel the PHS stadium it could be done using a combination of funds, including the possibility of using PPEL and SAVE funds on the track and/or stadium.

Why does the district have two ballot questions on the March 3, 2020 ballot?

In order to propose a tax-neutral facilities solution for Pleasantville Schools, the School Board authorized a vote in March asking our patrons to consider extending our SAVE Revenue purpose statement as well as our voted PPEL. As a result, there will be two questions on the ballot on March 3, 2020:

- Question #1 (Proposition B) asks for the approval of a revised Revenue Purpose Statement for the Secure an Advanced Vision for Education (SAVE) fund. This would grant the school district permission to continue to use state penny sales tax dollars toward facility maintenance and construction projects.

- Question #2 (Proposition C) asks voters if the district can continue to levy $1.34 / $1,000 of taxable valuation for Physical Plant and Equipment (PPEL). This would grant the school district permission to continue to use the PPEL funds toward facility maintenance projects.

Per Iowa state law, the SAVE revenue purpose statement and PPEL ballot questions each require a simple majority (more than 50%) to pass.

What is the difference between a Revenue Purpose Statement and a bond issue?

Neither the SAVE Revenue Purpose Statement nor the PPEL is a bond issue!

The Revenue Purpose Statement, if approved, would allow the district to continue to use statewide one-penny sales tax dollars (through a program called SAVE) toward facility maintenance and construction projects. More than 50% of district residents must vote in favor of the statement for it to pass.

A bond issue occurs when a school district seeks to exceed its state-imposed revenue limit to fund facilities projects. A bond requires the support of more than 60% of district residents to pass.

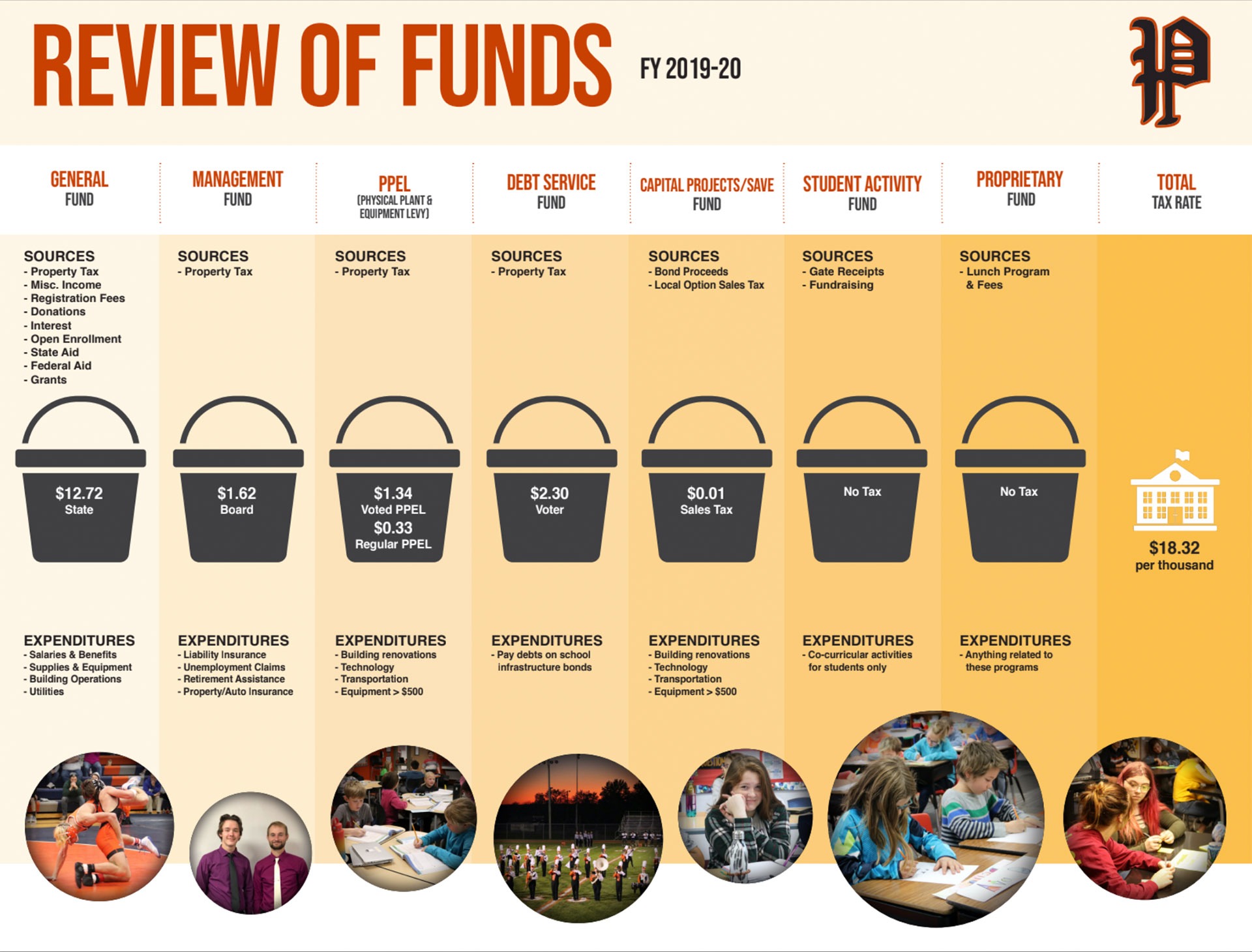

How is the Pleasantville school tax rate comprised?

Below is a visual showing how Pleasantville’s school tax rate is comprised. In addition to showing how school taxes are comprised, this visual outlines which “buckets of money” can be used for specific purposes only.

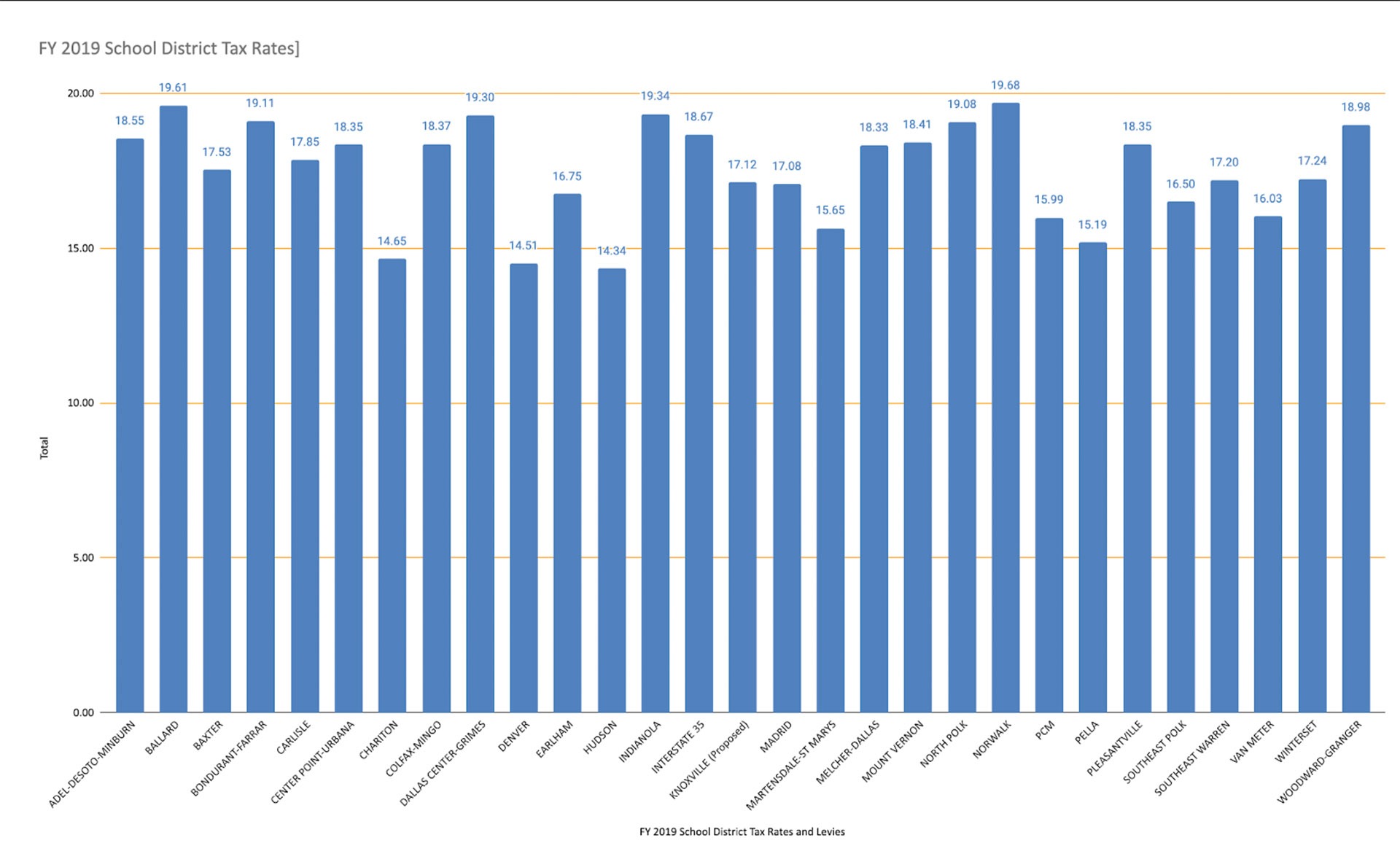

How does the Pleasantville school tax rate compare to other school district rates?

Below is a visual showing how Pleasantville’s current (FY19) school tax rate ($18.35) compares with other similar sized and/or geographically close proximity school districts. Data taken from the Iowa Department of Management website.

What would be the tax impact if both questions are approved by voters?

If district residents vote in favor of both of the questions on the ballot, it will allow Pleasantville Schools to continue with our facilities upkeep and facilities planning without raising local property taxes. In other words, if both questions are approved, the net increase in taxes will be zero!

What if only one of the two ballot questions are approved by voters?

The district’s next steps with facilities upkeep and planning would depend on which of the two questions are approved by voters. If this were to happen, the district and board would need to reassess our options to determine the best way to move forward.

What if both ballot questions are denied by voters?

If the PPEL and SAVE extension are both unsuccessful, the district would solicit feedback from voters on why the votes were unsuccessful and then continue to bring these matters back to the voters. It is worth noting that each time the school holds an election, we are charged a fee of approximately $2,500 by the county auditor’s office district for holding that election. Without the new revenue purpose statement and extension of PPEL, Pleasantville Schools will be unable to access those funds in the future.

Regarding PPEL: If this levy extension is unsuccessful the school district would lose approximately $276,000 annually in funding that can be used for building repairs, maintenance, technology, vehicles and other capital assets above $500. The district is asking voters for a continuation of the PPEL. PPEL is not a new tax and has been in place in Pleasantville since the early 1990s.

Regarding SAVE: As required by the legislation passed in 2019, the school district is asking patrons to consider passing a new “revenue purpose statement.” The revenue purpose statement is like a permission slip for the school district to access the SAVE 1-cent sales tax funds set aside for Pleasantville Schools by the State of Iowa. Pleasantville Schools receives approximately $725,000 per year from the state in SAVE funds, which can be used for building repairs, maintenance, technology, etc.

The biggest benefit to our taxpayers regarding SAVE is that we can use these funds for larger facilities projects without passing any sort of additional bond issues, which would be funded through additional property tax.

Both of these funds (SAVE and PPEL) allow the school district to build and keep our facilities in good shape without negatively impacting the quality of education. Without SAVE and PPEL, building upkeep and project expenses would have to be shifted to the General Fund which is where staff salaries, curriculum, and educational resources are paid from.

Where do we go to vote on March 3rd?

The voting location for Pleasantville School District is the Pleasantville Memorial Hall, 1010 N. Jefferson Street, Pleasantville, IA 50225. Polls are open from 7:00 am - 8:00 pm.

Will there be opportunities to vote early?

Absentee voting for the March 3, 2020 Special Elections for the Pleasantville Community School Districts has begun! Absentee voters may vote in person at the Auditor's office from 8:00 am - 4:30 pm Monday through Friday until March 2, or request that a mailed absentee ballot be sent to them. The last day to request a mailed ballot for this election and pre-register to vote is Friday, February 21 at 5:00 pm. Please see complete ballot language listed on the Sample Ballots below or click the link to view each ballot style. The County Auditor’s office has also provided a Polling Place Location List for voters specifically in the Pleasantville Community School Districts. https://www.marioncountyiowa.gov/electionspecial.htm

What type of voter identification is required to vote?

Pre-registered voters are required to provide an approved form of identification at the polling place before receiving and casting a regular ballot. Voters who are not pre-registered – such as voters registering to vote on Election Day – and voters changing precincts must also provide proof of residence. A voter who is unable to provide an approved form of identification (or prove residence if required) 1) may have the voter’s identity/residence attested to by another registered voter in the precinct, 2) prove identity and residence using Election Day Registration documents, or 3) cast a provisional ballot and provide proof of identity/residence at the county auditor’s office by Monday, March 9, 2020, at 12:00 pm (Noon). Election Day Registrant attesters must provide an approved form of identification. For additional information about providing proof of identity and/or residence visit: https://sos.iowa.gov/voterid or phone (641) 828-2217.

Any voter who is physically unable to enter a polling place has the right to vote in the voter’s vehicle. For further information, please contact the county auditor’s office at the telephone number or E-mail address listed below.

Telephone: (641) 828-2217

E-mail: jgrandia@marioncountyiowa.gov

What are the exact questions that will appear on the ballot on March 3, 2020?

Sample Ballots for both ballot questions are below:

- Pleasantville Question #1

Proposition B (SAVE Revenue Purpose Statement)

View PDF - Pleasantville Question #2

Proposition C (PPEL)

View PDF

What is the Income Surtax?

The district has elected to make a portion of the tax collected via income surtax so that property owners don’t bear the entire tax burden in this area. Without the amount brought in through the income surtax, Pleasantville Schools would have to offset the property tax levy by adding an additional $1.415 / $1,000 of taxable valuation to our current tax rate to offset the amount collected via the income surtax. Without the income surtax, only those who own property would be paying the tax. By making a portion of this tax an income tax, a portion of the amount collected is spread throughout the entire school district and includes those who don’t own property such as renters, multi-family homes, etc and all of the levy is not placed on property owners. We believe the end result is a more equitable way to spread the tax amongst all of the residents of the school district, not just those owning property.

What facilities projects have been done in the past with SAVE and PPEL?

Some of the major projects we have done through the SAVE and PPEL funds include:

2019

- Roof Repairs

- Baseball field improvements

- 1:1 student laptops

- Sidewalk maintenance and repairs

- Maintenance Truck

2018

- Elementary classroom furniture

- Baseball field and stadium improvements

- Softball field improvements

- New school bus

2017

- Roof repairs

- Security cameras

- Baseball field improvements

- Softball field improvements

2016

- Tuckpointing (exterior brick repair)

- Security door locks

- LED light bulb conversion

2015

- Property purchase (lot across from softball field)

- Student laptop computer software upgrades

- Gator vehicle

2014

- HVAC upgrades & updates

- Student laptop computer software upgrades

2013

- Student laptop computers

- Gator vehicle

- HVAC upgrades & updates

- Restroom remodel

- Classroom furniture

- Maintenance equipment

2012

- Energy audit

- Technology upgrades

- Photography equipment

- Bleacher repairs

- Elementary HVAC

- Restroom remodels

- Locker room remodel

- HVAC upgrades

- Sewer replacement

- Fire alarm updates

- Gym lighting updates

- Security cameras and doors

- Park restrooms

- Irrigation

2011

- Software upgrades

- Fire alarm upgrades

- Door replacement

- Greenhouse

- Elementary HVAC

- Security upgrades

2010

- Technology upgrades

- HVAC updates

2009

- Technology upgrades

- HS carpet replacement

- Door replacement

- Land purchase

2008

- Technology upgrades

- Roof repairs

2007

- Technology upgrades

- Bus engine

- Event Center

- Fitness Center

- Bus barn paving

2006

- Event center

- Fitness Center

- Bus garage

2005

- Event center

- Fitness Center

- Technology upgrades

- Basketball courts

- Boiler upgrades